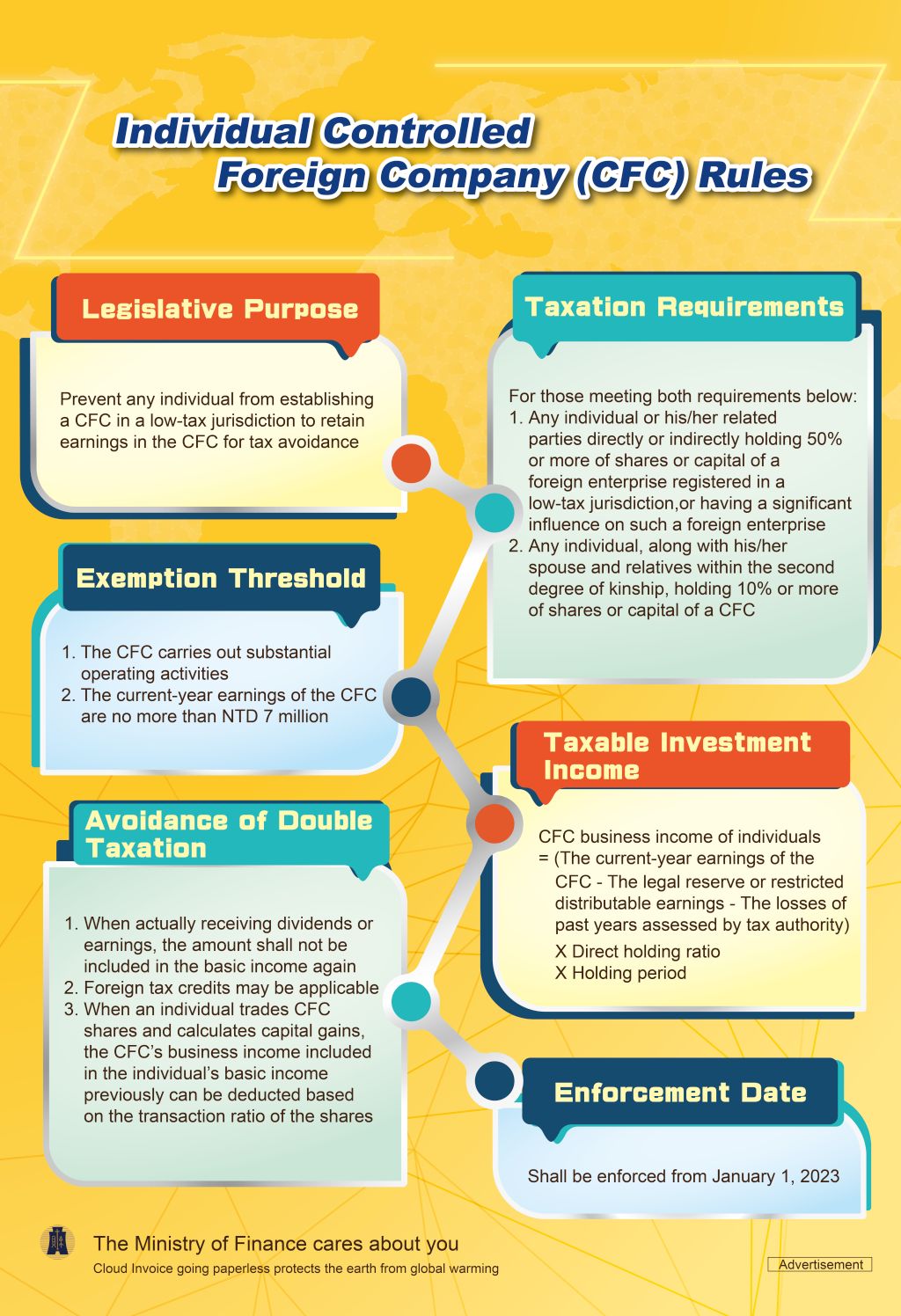

Individual Controlled Foreign Company (CFC) Rules

Legislative Purpose

Prevent any individual from establishing a CFC in a low-tax jurisdiction to retain earnings in the CFC for tax avoidance

Taxation Requirements

For those meeting both requirements below:

1. Any individual or his/her related parties directly or indirectly holding 50% or more of shares or capital of a foreign enterprise registered in a low-tax jurisdiction, or having a significant influence on such a foreign enterprise

2. Any individual, along with his/her spouse and relatives within the second degree of kinship, holding 10% or more of shares or capital of a CFC

Exemption Threshold

(1) The CFC carries out substantial operating activities

(2) The current-year earnings of the CFC are no more than NTD 7 million

Taxable Investment Income

CFC business income of individuals

= (The current-year earnings of the CFC-The legal reserve or restricted distributable earnings –The losses of past years assessed by tax authority) X Direct holding ratio X Holding period

Avoidance of Double Taxation

1. When actually receiving dividends or earnings, the amount shall not be included in the basic income again

2. Foreign tax credits may be applicable

3. When an individual trades CFC shares and calculates capital gains, the CFC’s business income included in the individual's basic income previously can be deducted based on the transaction ratio of the shares

Enforcement Date

Shall be enforced from January 1, 2023